In the evolving landscape of global development, grassroots models are proving to be powerful engines of change. The Village Savings and Loan Association (VSLA) is a prime example of this, empowering communities with a sustainable, self-managed financial system. VSLAs are a key component of Oxfam's work in Nigeria, addressing gender justice and women's rights by increasing financial assets and reducing vulnerability. This post provides an analytical look into the pilot implementation of VSLAs in Southern Nigeria through the Fair for All project, a partnership between Oxfam in Nigeria and the KEBETKACHE Women Development and Resource Centre.

Among the four project's pathways is to deepen financial inclusion and empower women to become financially independent while strengthening local governance and accountability. Following a five-day training program for 38 participants from Akwa Ibom, Cross River, and Rivers States in the second quarter of 2024, a monitoring visit was conducted in the same quarter of 2025 to evaluate the VSLAs' effectiveness, identify operational gaps, and gather direct feedback from over 10 newly established groups.

A group of women are gathered in a community under a canopy of trees, sitting around a table for a VSLA meeting. Photo credit: Maxwell Osarenkhoe/Oxfam

The monitoring visit revealed several examples of successful VSLA implementation, highlighting the power of community-led initiatives and mirroring broader successes across the country. In previous projects, Oxfam has reported VSLAs achieving a higher return on assets than traditional bank savings accounts.

- Innovative Livelihood Support: The Able Ladies VSLA in Ibeno, Uyo, demonstrated remarkable creativity by using their social fund to purchase a fishing net. This net is rented out to local fishermen, generating a sustainable income stream that is then used to support community members in need, such as widows and orphans. This model moves beyond simple savings to a proactive, income-generating social enterprise.

- Structured Governance: Strong leadership is a cornerstone of effective VSLAs. The KEBETKACHE VSLA (partner-owned group) in Rivers State showcased a well-defined leadership structure with a president, treasurer, bookkeepers, and three keyholders, which ensures a clear division of roles and strong accountability.

- Disciplined Savings Culture: The Amazing Grace VSLA in Tai LGA, Rivers State has established a fixed weekly contribution of ₦2,000 per member. This consistent, predictable savings model ensures steady growth and financial predictability for the group.

- Effective Risk Mitigation: Some groups have implemented smart measures to protect their shared funds. For example, the Excellent People VSLA in the Abak community, Uyo, requires two guarantors for loans exceeding ₦50,000, a key strategy to minimize the risk of default.

A close-up shot of a person's hand using a key to unlock a metal savings box, highlighting the secure nature of the Village Savings and Loan Association (VSLA) model. Photo credit: Maxwell Osarenkhoe/Oxfam

Hurdles to Sustainability

While many VSLAs are thriving, significant challenges pose a risk to their long-term sustainability. These issues highlight the need for systemic improvements and continued support:

- Governance Gaps and Lack of Formalization: Some VSLAs, like the Peace VSLA in Erema Community, were still in the process of formalizing their constitution, leading to gaps in decision-making and accountability. A common issue was the assignment of multiple roles to a single individual, which can lead to limited member participation and a higher risk of mismanagement.

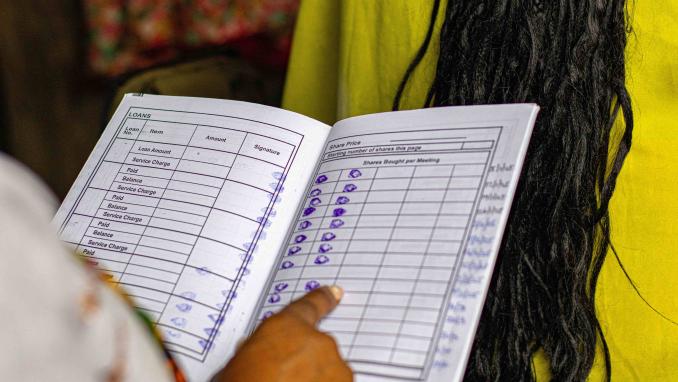

- Inconsistent Practices and Record-Keeping: Accurate record-keeping was identified as a major challenge. While some groups used official passbooks, others relied on improvised notebooks, which are vulnerable to damage and loss. In one case, a group lost all its savings records when a rodent destroyed their notebook. As one member from the Excellent VSLA noted, "Sometimes I don't even know what my loan is recorded as, because we don't check the book every meeting".

- Accountability and Trust Issues: A critical vulnerability observed was the practice of entrusting group funds to the personal bank accounts of trusted members. This arrangement, while based on trust, is unsustainable and poses a significant risk. This was tragically demonstrated in a case where a record keeper absconded with ₦120,000, forcing the group to suspend all loan activities.

- Misaligned Expectations: A recurring issue was the community's misunderstanding of Oxfam's role. Many members expected direct financial assistance, which risks undermining the core principle of self-reliance and the sustainability of the VSLA model itself.

A group of women gathered outside, with one woman holding up a smartphone showing a mobile application to another. This illustrates the use of digital tools for VSLA record-keeping. Photo credit: Maxwell Osarenkhoe/Oxfam

Recommendations for a Resilient Future

To ensure the long-term success of VSLAs, a multi-pronged approach is necessary to address the identified gaps:

- Strengthening Systems: Distribute standardized tools such as official VSLA passbooks and financial templates to ensure uniformity and accountability. A standard constitution template should also be developed for groups to adapt.

- Improving Financial Transparency: Support groups in opening corporate bank accounts with multiple signatories. This will improve transparency, enhance security, and lay the groundwork for accessing formal credit facilities in the future.

- Enhanced Capacity Building: Implement refresher training that reinforces VSLA principles and includes advanced modules on financial management and leadership. This training should also emphasize the rotation of responsibilities to avoid over-reliance on a single individual.

- Clarity in Communication: Develop and distribute communication materials that clearly articulate that only technical support and not direct funds will be provided. This is essential for resetting community expectations and fostering a culture of self-reliance.

- Introduce Digital Tools: For literate clusters, explore the use of simple mobile apps to track savings and loans. This would reduce the risk of data loss and improve accountability.

A male facilitator in a blue shirt speaks to a group of women during a VSLA meeting. An elderly woman is seated in the foreground. Photo credit: Maxwell Osarenkhoe/Oxfam

By addressing these challenges, the VSLA model can fully realise its potential, not just as a financial tool, but as a catalyst for inclusive community development. In previous projects, Oxfam has seen VSLAs serve as platforms for conflict resolution, increased agricultural productivity, and women's empowerment, demonstrating their ability to create wide-ranging positive change in communities.